Avalara is a leading tax compliance software that offers a comprehensive solution for businesses of all sizes. It automates the complex process of tax compliance, ensuring accuracy and reducing costs. With its cloud-native platform, Avalara provides regularly updated, address-specific tax rates, and access to a vast database of tax content, rates, and rules for over 190 countries. The software offers a range of features, including rate calculation with geolocation and product classification, automated returns filing and remittance, and sales tax registration. It also simplifies certificate management by allowing users to collect, store, and access exemption and compliance documents. Avalara's solutions are tailored to the needs of small, midsize, and enterprise businesses. For small businesses, it simplifies sales tax returns, registrations, and calculations, and integrates with popular marketplaces and ecommerce platforms. Midsize businesses can benefit from scalable solutions that save time and reduce the workload for staff. Enterprise businesses have access to solutions for complex, multinational operations, enabling them to calculate rates across a range of tax types. In addition to its domestic solutions for the U.S. and Canada, Avalara also offers cross-border solutions for international sales. It helps businesses assign tariff codes, apply VAT and GST rates, and handle duties and cross-border tariffs. Avalara has over 41,000 customers in more than 75 countries and is trusted by businesses worldwide to streamline their tax compliance processes.

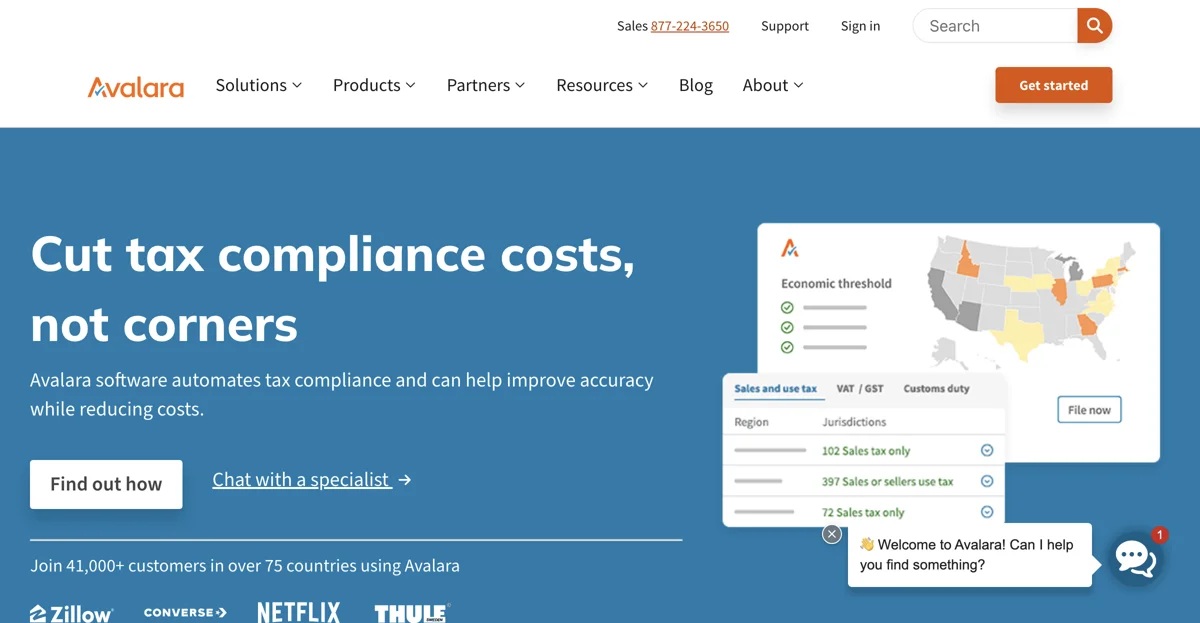

Avalara

Avalara automates tax compliance, improves accuracy, and reduces costs. Discover its solutions for businesses of all sizes.

Top Alternatives to Avalara

UltimateTax

UltimateTax is a professional tax software with diverse features to aid tax preparers.

TurboTax

TurboTax is an AI-powered tax filing tool that simplifies the process

H&R Block

H&R Block is an AI-powered tax filing service that maximizes refunds

TaxGPT

TaxGPT is an AI tax assistant that boosts firm productivity

Taxfyle

Taxfyle is an AI-powered tax and accounting service that offers expert assistance.

OnLine Taxes at OLT.COM

OnLine Taxes offers accurate tax filing with various features

Drake Software

Drake Software is an AI-powered tax prep tool that streamlines returns

Sovos Compliance

Sovos offers comprehensive tax compliance solutions

Decode.tax

Decode.tax is an AI-powered tax analysis tool that helps users understand and lower their tax bills.

CPA Pilot

CPA Pilot is an AI chatbot designed to assist tax professionals in performing tax work with the expertise of a 20-year veteran.

Black Ore

Black Ore is an AI-powered tax preparation platform designed specifically for CPAs, streamlining tax filing processes.

Simpla

Simpla is an AI-powered tax and accounting compliance solution that offers businesses faster and more affordable compliance services.

United Tax

United Tax offers AI-enhanced tax preparation services for individuals and businesses, ensuring accuracy and tax optimization.

ARTE

ARTE is an AI-powered tax research assistant that provides instant, accurate answers to complex tax questions, outperforming human CPAs.

CanTax.ai

CanTax.ai is an AI-powered tax assistant that provides personalized, secure, and comprehensive tax advice to Canadians 24/7.

Accountable

Accountable is an AI-powered tax assistant that helps self-employed individuals manage their taxes efficiently and error-free.

Taxly.ai

Taxly.ai is an AI-powered tax assistant that automates tax deductions and filings for self-employed individuals in Australia.

Wolters Kluwer

Wolters Kluwer offers AI-powered tax and accounting solutions

Vertex, Inc.

Vertex, Inc. offers tax technology solutions for businesses

TaxSlayer

TaxSlayer is an online tax filing platform that offers various plans for users.

1040.com

1040.com is an AI-powered tax filing platform that simplifies the process