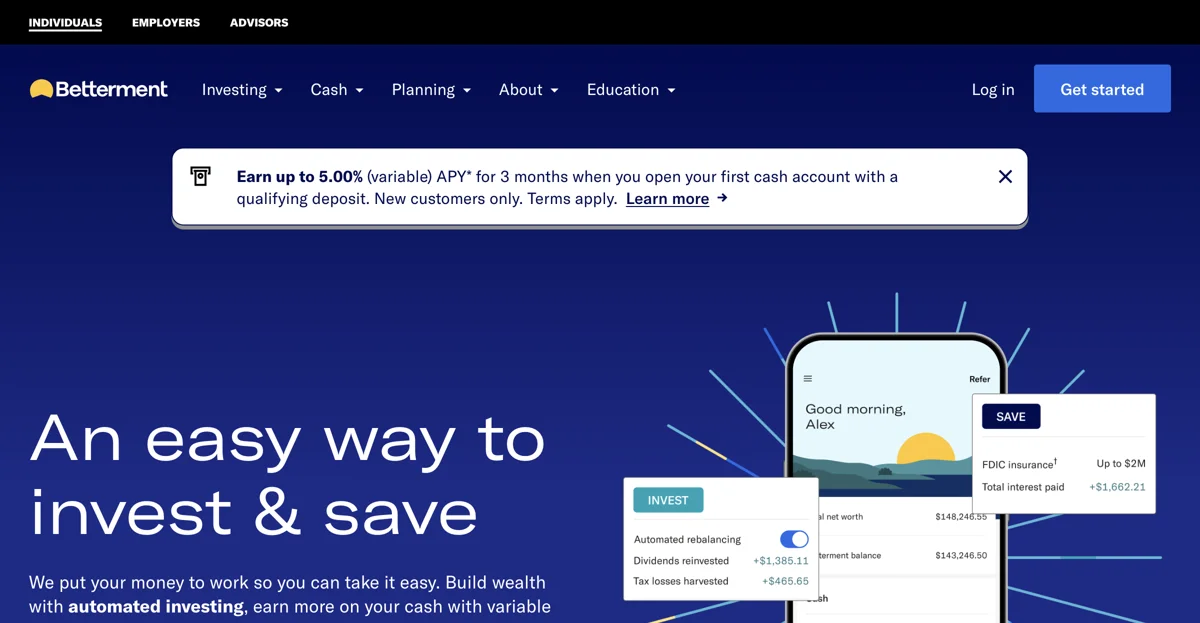

Betterment is a comprehensive investment platform that offers a range of features to help users manage their finances. It provides automated investing, allowing users to build a diversified portfolio with expert-built strategies. With a focus on minimizing taxes and maximizing returns, Betterment manages users' money to help them achieve their financial goals. The platform offers high-yield cash accounts with a variable 4.50% APY*, which is significantly higher than the national average. Users can also take advantage of tax-efficient tools like tax-loss harvesting to boost their after-tax returns. Betterment's IRA options provide tax benefits and a full suite of planning tools to help users save for retirement. The platform also offers recurring deposit features to keep users' money on track and potentially earn even more. In addition to its investment and savings offerings, Betterment has received recognition as the Best Overall Robo Advisor for 2024 by the Buy Side from Wall Street Journal and a 5-star rating from Nerdwallet. With over 900,000 customers and $50+ billion in assets under management, Betterment has a proven track record of helping users make the most of their money. Whether you're looking to build wealth, save for retirement, or earn more on your savings, Betterment offers a user-friendly and effective solution.

Betterment

Betterment is an AI-driven investment platform with automated investing, high-yield savings, and retirement planning tools.

Top Alternatives to Betterment

Sturppy

Sturppy is an AI-powered financial planning tool that saves time

MoneyPatrol

MoneyPatrol is an AI-powered finance management tool that helps users track expenses and manage finances.

EveryDollar

EveryDollar is an AI-powered budgeting app that simplifies finance management

Workday Adaptive Planning

Workday Adaptive Planning is an AI-powered EPM software with multiple capabilities

Daloopa

Daloopa is an AI-powered tool that simplifies financial modeling

SymphonyAI

SymphonyAI is an AI-powered financial crime prevention SaaS that transforms operations

Financial Flow

Financial Flow is an AI-powered platform that revolutionizes financial news consumption with smart summaries and real-time insights.

Copilot Money

Copilot Money is an AI-powered financial planning app that helps users track spending, budgets, and investments with ease.

finbots.ai

finbots.ai offers AI-powered credit scoring solutions to enhance lending efficiency and reduce risks.

Personetics

Personetics is an AI-powered platform that enhances financial institutions' customer engagement through personalized experiences and actionable insights.

Nume

Nume is an AI-powered financial planning tool that helps startup founders manage their finances efficiently.

finance_stuff

finance_stuff is an AI-powered personal finance tracker that helps users manage their finances and investments effortlessly.

SpendSights

SpendSights is an AI-powered expense manager that helps users track and categorize their bank transactions for better financial insights.

FinWheel

FinWheel is an AI-powered financial consultant that helps businesses and employees manage 401K/IRA plans efficiently.

Skwad

Skwad is a privacy-first budgeting app that syncs transactions using bank email alerts, offering a secure way to manage finances without linking your bank account.

Quicken Personal Finance and Money Management Software

Quicken is a comprehensive financial management tool that helps users control their finances, budgeting, spending, savings, and investments.

Numra

Numra is an AI-powered finance assistant that automates end-to-end finance processes, increasing productivity and reducing errors.

Mezzi

Mezzi is an AI-powered financial planning tool that helps users optimize their investments and save on taxes.

CloudVerse AI

CloudVerse AI is a FinOps platform that provides comprehensive cloud cost visibility and optimization insights for finance, engineering, and business teams.

Kairos Financial

Kairos Financial offers AI-driven wealth management solutions tailored to your financial goals.

Briq

Briq is an AI-powered financial automation platform designed to streamline construction business operations, ensuring predictable profits and accurate data.