Kyber revolutionizes the way insurance professionals handle claim notices by leveraging advanced AI technology. This innovative tool is specifically designed for claim adjusters and other insurance professionals, aiming to eliminate the tediousness associated with sending claim notices. With Kyber, teams can instantly draft, review, and send complex insurance notices, allowing them to focus on what's most important.

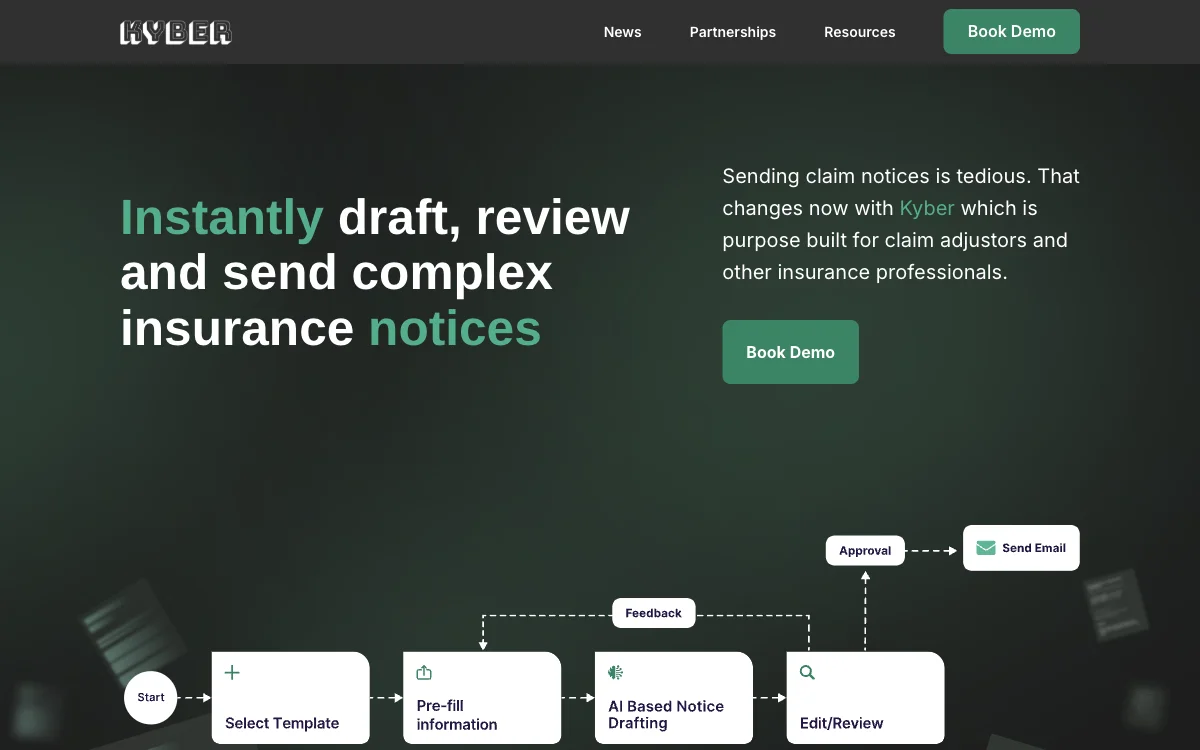

Kyber's letter generation AI and workflow significantly reduce the time and effort required to create insurance notices. By using AI and custom templates, Kyber streamlines the notice creation process. Users can build custom templates from scratch or choose from a library of common notices. The AI then drafts customer notices using these templates, ensuring quality and accuracy for any policy or claim.

The benefits of using Kyber are substantial. It reduces the time spent drafting claim notices by 85% and reviewing them by 60%, enabling 3x faster outreach to policyholders. Kyber also emphasizes security and compliance, offering a secure API pipeline and handling insurance customer data with the utmost care. The platform is in the process of achieving SOC 2 Type II certification, demonstrating its commitment to security.

Kyber's integration capabilities allow it to work seamlessly with existing claims systems and mailing systems, automating and expediting communications. This not only enhances operational efficiency but also improves the customer experience by ensuring quick and consistent communication.

In summary, Kyber is a game-changer for the insurance industry, offering a secure, efficient, and user-friendly solution for managing complex insurance notices. Its AI-driven approach saves time, reduces errors, and enhances the overall customer experience.