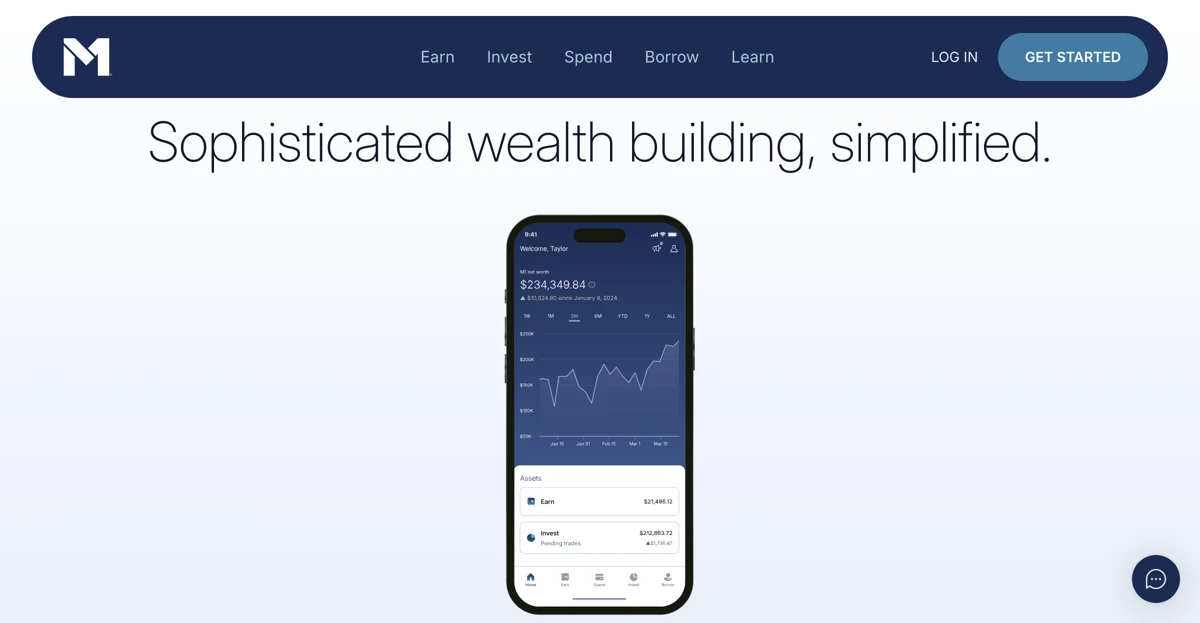

M1 Finance: The Finance Super App™

M1 Finance is revolutionizing the way we manage our wealth with its sophisticated yet user-friendly platform. With over 1,000,000 users and $9 billion in client assets as of May 2024, M1 Finance is not just another finance app; it’s a comprehensive solution for modern investors.

Overview of M1 Finance

Founded in 2015, M1 Finance combines investing, banking, and borrowing into one seamless experience. Whether you’re looking to earn, invest, spend, or borrow, M1 has you covered. Here’s a closer look at what M1 Finance offers:

EARN

With a High-Yield Cash Account, you can rack up an impressive 4.50% APY on your balance. This is a great way to make your money work for you while maintaining liquidity.

INVEST

M1 allows you to customize your portfolio with over 6,000 stocks and ETFs. You can set your investment strategy and let M1 handle the rest with its automated investing feature.

SPEND

Reward yourself with up to 10% cash back using the Owner’s Rewards Card by M1. This card is designed to maximize your spending rewards while you manage your finances.

BORROW

Need quick access to cash? M1 lets you borrow against your investment portfolio at a competitive 6.75%. This feature allows you to tap into your portfolio’s power without selling your investments.

Key Features

Automated Investing

Put your investment strategy on cruise control. You choose your investments, allocations, and deposit schedule, and M1 takes care of the rest.

Dynamic Rebalancing

No more napkin math! M1 intelligently rebalances your portfolio over time, ensuring you stay on track with your investment goals.

Account Protections

M1 Finance is a member of SIPC, protecting your securities up to $500,000. Additionally, all deposits in High-Yield Cash Accounts are FDIC-insured up to $3.75 million.

Awards and Recognition

M1 Finance has received accolades for its innovative approach:

- Best for Sophisticated Investors (Investopedia, 2024)

- One of Time’s Best Investing Apps (Time, 2024)

- Best for Money Management (Moneywise, 2024)

Pricing and Fees

M1 Finance does not charge commission, trading, or management fees for self-directed brokerage accounts. However, be aware of potential platform fees and other charges. For a complete list of fees, visit M1’s .

FAQs

Is M1 Finance a bank?

No, M1 is a technology company offering financial products and services, but it is not a bank.

How does the cash back work?

You can earn between 2.5% to 10% cash back on qualifying purchases based on M1’s rewards tiers.

What are the risks?

All investing involves risk, including the risk of losing the money you invest. It’s essential to review M1’s margin account risk disclosure before borrowing.

Conclusion

M1 Finance is an all-in-one solution for those looking to take control of their financial future. With its user-friendly interface and powerful tools, it’s no wonder that over 60,000 users have left 5-star reviews.

Ready to upgrade your wealth-building experience?