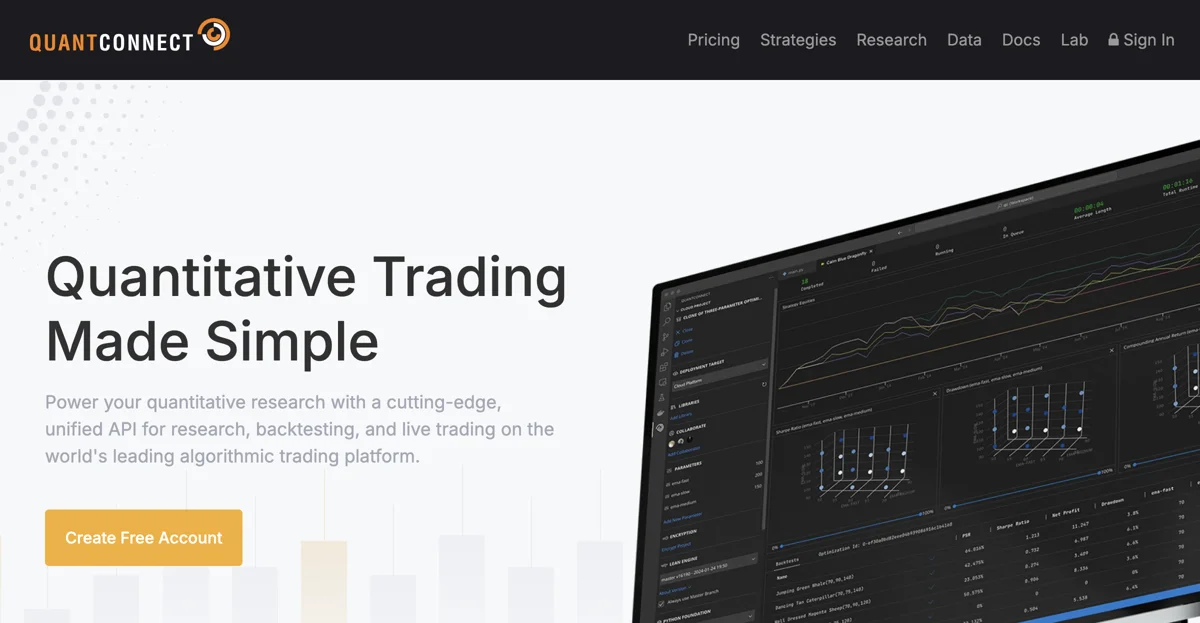

QuantConnect stands at the forefront of algorithmic trading, providing a comprehensive suite of tools designed to empower quantitative researchers, data scientists, and engineers. With its cutting-edge, unified API, users can seamlessly transition from research and backtesting to live trading on the world's leading algorithmic trading platform. The platform boasts an award-winning quant analytics platform, supported by a vibrant community of 318K quants, and facilitates over 500K backtests per month, handling a volume of $2B monthly with returns exceeding the market by +7%.

QuantConnect's cloud and on-premise solutions offer a unified quant infrastructure, essential for navigating the rapidly expanding universe of data and accelerating technological advancements. The platform's cloud-based tools enable the research of investment approaches, strategy assessment through backtesting, and rapid deployment to maximize returns. For those with bespoke requirements or proprietary datasets, QuantConnect's Local Platform replicates the full QuantConnect experience on-premise.

The platform's process from research to production is streamlined, starting with cloud research terminals that provide access to terabytes of financial, fundamental, and alternative data, preformatted and ready for use. QuantConnect's alternative data is meticulously linked to underlying securities, tagged with identifiers like FIGI, CUSIP, and ISIN, facilitating the building of robust strategies. The platform also supports popular machine learning and feature selection libraries, allowing users to quantify factor importance and train machine learning models.

QuantConnect's multi-asset portfolio modeling accurately tracks real-time strategy equity across complex portfolios in both backtesting and live trading scenarios. The platform supports a wide range of assets, including equity, equity options, indexes, index options, futures, future options, forex, CFD, and crypto, offering realistic portfolio modeling and margin management.

The platform's rich library of alternative data, sourced from over 40 distinct vendors, provides orthogonal signals critical for building robust strategies. Each dataset is processed with a uniform timestamp and delivered point-in-time to avoid selection bias, ready for use in live trading or on-premise research through the Datasets Marketplace.

At the core of QuantConnect is LEAN, an open-source algorithmic trading engine developed by over 180 engineers. LEAN offers modeling that surpasses the best financial institutions globally, providing the freedom to modify the platform to suit specific needs. The LEAN CLI facilitates local development and cloud backtesting, allowing users to code in their preferred development environment and synchronize projects to the cloud.

QuantConnect's global community of 317,800 quants, researchers, data scientists, and engineers is the largest quant research community in the world. The community shares over 1,200 strategies through forums and a vast library of public quant research, with users creating 2,500 new algorithms and writing 1M lines of code on average each month.

QuantConnect's commitment to providing powerful financial tools for every stage of the quant journey makes it an indispensable platform for anyone looking to leverage algorithmic trading for quantitative research and investment strategy development.