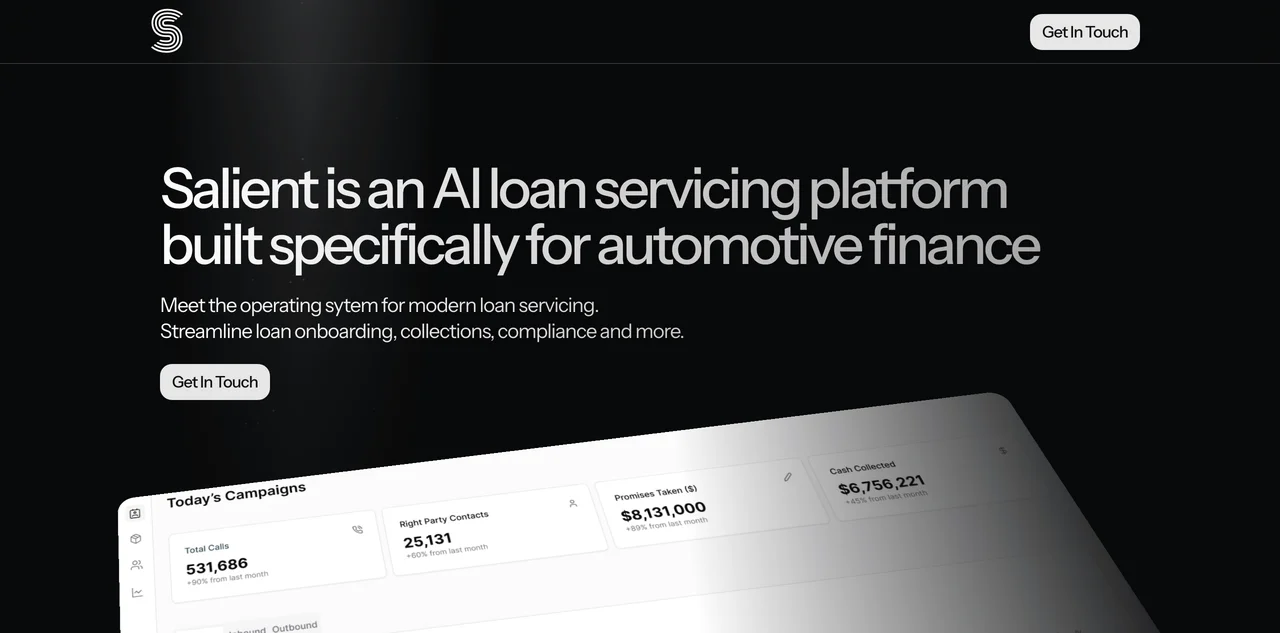

Salient represents a significant advancement in the field of automotive finance, offering a comprehensive AI loan servicing platform. This innovative solution is tailored to meet the unique needs of modern automotive lenders, focusing on streamlining loan onboarding, collections, compliance, and more. With its AI agents, Salient facilitates real-time interactions with consumers through various channels including voice, text, email, and web chat. These interactions are designed to handle a range of tasks such as collecting payments, processing due date changes and extensions, managing payoffs, and updating insurance information.

What sets Salient apart is its commitment to integrating seamlessly with existing systems. Whether it's your contact center, payment processor, or loan management system (LMS), Salient ensures that your operations are more efficient and data-driven. The platform supports integration with any API-driven payment processor, including Stripe, ACI, PayNearMe, and Nowpay, and can retrieve and push borrower updates in real time to your existing LMS, such as OFSLL, Shaw Systems, or Nortridge.

Salient is built on the principles that distinguish world-class automotive lenders: a relentless focus on streamlining operations, surfacing high-quality data at all points, and a commitment to optimizing the consumer experience. This makes it an invaluable tool for lenders looking to stay ahead in the competitive automotive finance industry.

With its robust features, including AI agents for compliance workflow, Salient not only enhances operational efficiency but also ensures that lenders can offer a superior service to their customers. The platform's ability to integrate with existing solutions and its focus on the automotive lending industry make it a trusted choice for tech-forward lenders.