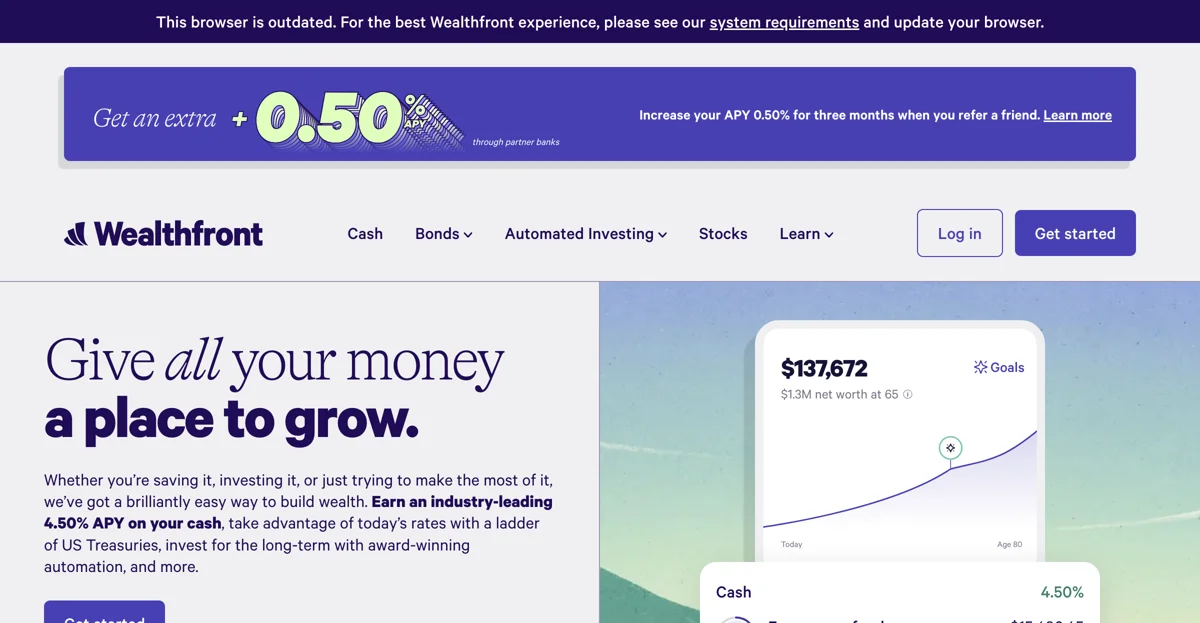

Wealthfront is a comprehensive investment platform that offers a range of services to help users build and manage their wealth. It provides high-yield savings with a 4.50% APY through partner banks, making it an attractive option for short-term savings. The platform also offers a ladder of US Treasuries, which are exempt from state and local income taxes and offer a relatively low-risk investment option. For long-term goals, Wealthfront's automated, diversified index investing helps users limit risk, minimize taxes, and maximize returns. It also offers a smarter way to discover and buy stocks, allowing users to make more strategic choices. The platform is designed to be user-friendly, with no account fees, unlimited transfers, and free same-day withdrawals. It also has no minimum or maximum balance requirement to earn the 4.50% APY. With up to $8M FDIC insurance through partner banks, users' funds are protected. Wealthfront's services are suitable for various needs, whether it's for daily expenses, emergency funds, or long-term investments. It has received positive reviews from clients, highlighting its effectiveness in maximizing returns and managing finances. Overall, Wealthfront is a reliable and innovative investment platform that offers a variety of options to meet the diverse needs of investors.

Wealthfront

Wealthfront offers a brilliant way to build wealth with high-yield savings, Treasuries, and diversified investing.

Top Alternatives to Wealthfront

Sturppy

Sturppy is an AI-powered financial planning tool that saves time

MoneyPatrol

MoneyPatrol is an AI-powered finance management tool that helps users track expenses and manage finances.

EveryDollar

EveryDollar is an AI-powered budgeting app that simplifies finance management

Workday Adaptive Planning

Workday Adaptive Planning is an AI-powered EPM software with multiple capabilities

Daloopa

Daloopa is an AI-powered tool that simplifies financial modeling

SymphonyAI

SymphonyAI is an AI-powered financial crime prevention SaaS that transforms operations

Financial Flow

Financial Flow is an AI-powered platform that revolutionizes financial news consumption with smart summaries and real-time insights.

Copilot Money

Copilot Money is an AI-powered financial planning app that helps users track spending, budgets, and investments with ease.

finbots.ai

finbots.ai offers AI-powered credit scoring solutions to enhance lending efficiency and reduce risks.

Personetics

Personetics is an AI-powered platform that enhances financial institutions' customer engagement through personalized experiences and actionable insights.

Nume

Nume is an AI-powered financial planning tool that helps startup founders manage their finances efficiently.

finance_stuff

finance_stuff is an AI-powered personal finance tracker that helps users manage their finances and investments effortlessly.

SpendSights

SpendSights is an AI-powered expense manager that helps users track and categorize their bank transactions for better financial insights.

FinWheel

FinWheel is an AI-powered financial consultant that helps businesses and employees manage 401K/IRA plans efficiently.

Skwad

Skwad is a privacy-first budgeting app that syncs transactions using bank email alerts, offering a secure way to manage finances without linking your bank account.

Quicken Personal Finance and Money Management Software

Quicken is a comprehensive financial management tool that helps users control their finances, budgeting, spending, savings, and investments.

Numra

Numra is an AI-powered finance assistant that automates end-to-end finance processes, increasing productivity and reducing errors.

Mezzi

Mezzi is an AI-powered financial planning tool that helps users optimize their investments and save on taxes.

CloudVerse AI

CloudVerse AI is a FinOps platform that provides comprehensive cloud cost visibility and optimization insights for finance, engineering, and business teams.

Kairos Financial

Kairos Financial offers AI-driven wealth management solutions tailored to your financial goals.

Briq

Briq is an AI-powered financial automation platform designed to streamline construction business operations, ensuring predictable profits and accurate data.