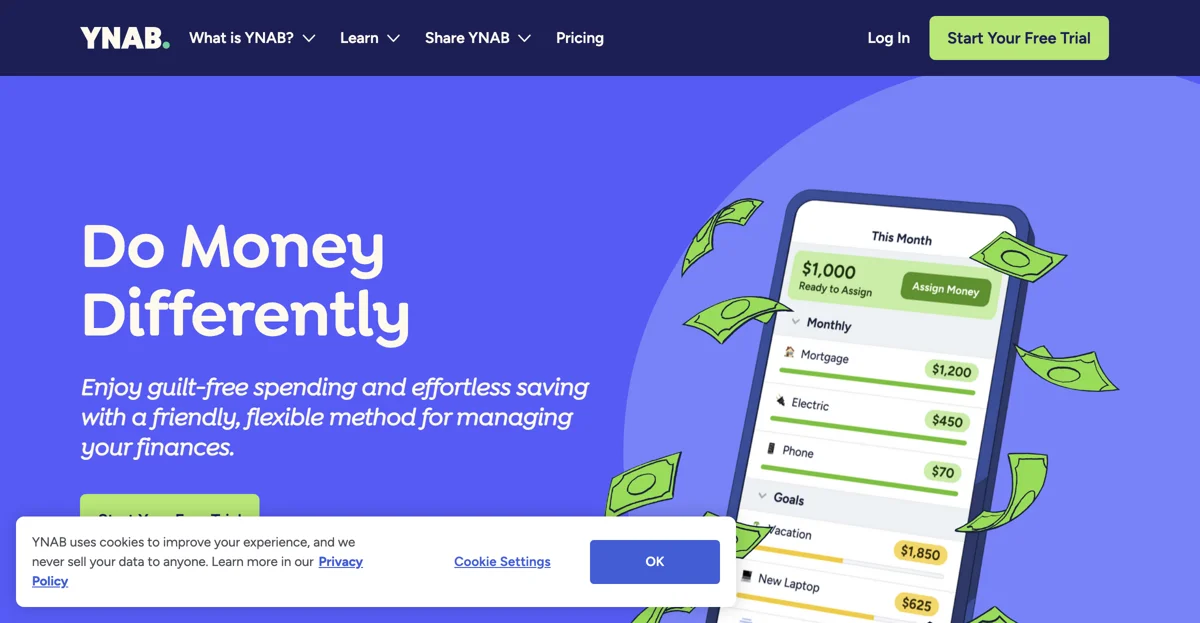

YNAB: Transform Your Financial Life with Ease

YNAB, short for You Need A Budget, is a revolutionary financial planning tool designed to help individuals and families manage their finances with confidence and clarity. Since its inception in 2004, YNAB has empowered millions to take control of their money, reduce financial stress, and achieve their financial goals.

What Makes YNAB Stand Out?

YNAB is not just another budgeting app; it’s a comprehensive financial management system that teaches users to allocate every dollar effectively. With a TrustScore of 4.7 and over 71,000 positive reviews, YNAB has been recognized as the Best Budgeting App of 2024 and is featured among the World's Top 250 Fintechs.

The Four Rules of YNAB

YNAB’s methodology is built around four simple yet transformative rules:

-

Give Every Dollar a Job: Assign a purpose to each dollar you earn before you spend it. This proactive approach helps you visualize your financial plan and ensures that your spending aligns with your goals.

-

Embrace Your True Expenses: Break down irregular expenses, such as car repairs or holiday shopping, into manageable monthly amounts. This foresight prevents financial surprises and keeps your budget balanced.

-

Roll with the Punches: Life is unpredictable, and so is your budget. YNAB encourages flexibility, allowing you to adjust your spending plan as circumstances change without guilt.

-

Age Your Money: Aim to use last month’s income for this month’s expenses. This practice helps you stay ahead financially and reduces the stress of living paycheck to paycheck.

How to Get Started with YNAB

Starting with YNAB is straightforward and risk-free. New users can enjoy a 34-day free trial without the need for a credit card. Here’s how you can begin:

- Sign Up for Free: Begin your journey with YNAB by signing up for the trial period.

- Create a Money Plan: Add your financial accounts, set savings goals, and share your budget with family members if desired.

- Experience Less Stress: As you implement YNAB’s principles, you’ll gain confidence and peace of mind in your financial life.

Success Stories

YNAB users often report significant financial improvements. On average, a YNAB user saves $600 within the first two months and $6,000 in the first year. Here are some testimonials:

- Alex: "I took the plunge and am loving it! It’s increased my personal financial awareness and has helped my partner and I budget for some amazing purchases."

- Laura & Matthew: "Managing money together has been life-changing. YNAB has allowed us to experience a peace around money that I don’t think I ever thought was possible."

- Danielle: "I stress so much less when unexpected things come up. Now we're modeling good financial choices for our kids."

Pricing

YNAB offers a subscription model, with pricing details available on their official website. Prices are subject to change, so it’s advisable to check for the latest information.

Why Choose YNAB?

YNAB is more than just a budgeting tool; it’s a lifestyle change. By simplifying the way you manage money, YNAB helps you organize your finances and life. Whether you want to stop arguing about money, feel more organized, or simply enjoy adulthood without financial stress, YNAB is your partner in achieving these goals.

Call to Action

Ready to transform your financial life? Start your free trial of YNAB today and discover the peace of mind that comes with financial clarity and control.

YNAB is a powerful tool for anyone looking to improve their financial health. With its user-friendly interface and proven methodology, it’s no wonder YNAB is a top choice for budgeting enthusiasts worldwide. 🌟