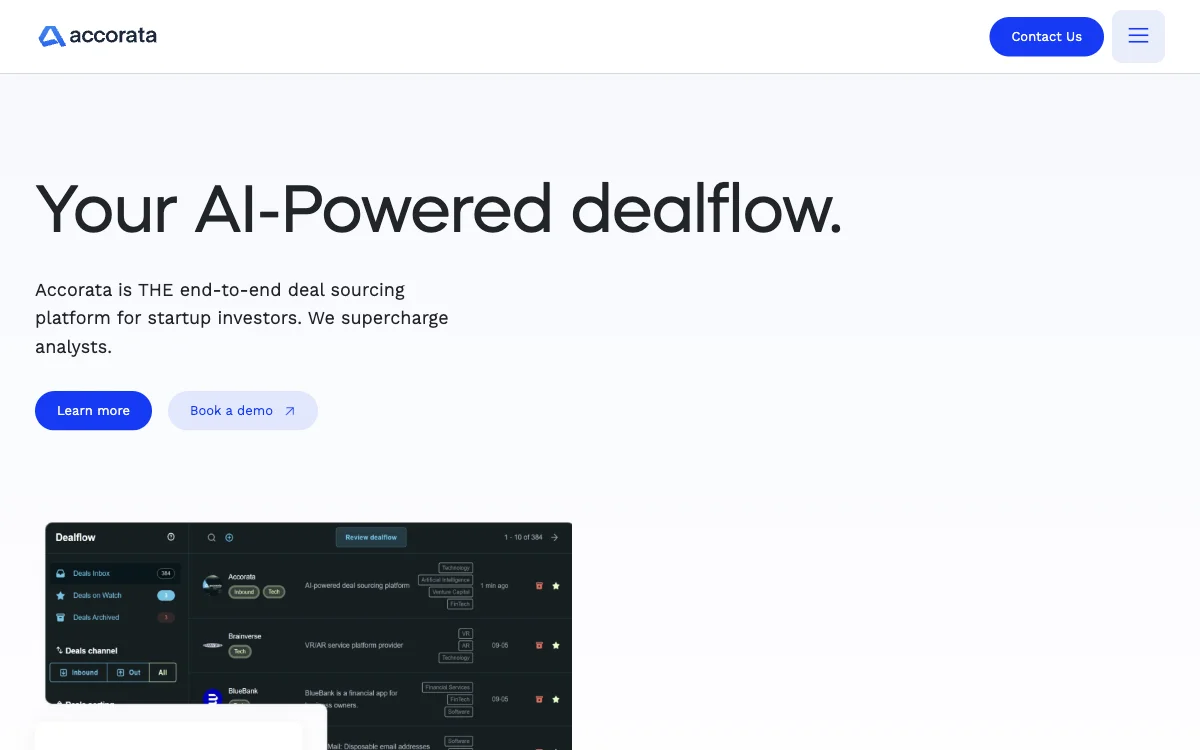

Accorata stands out as a revolutionary AI-powered deal sourcing platform designed specifically for startup investors. It offers an end-to-end solution that not only expands your deal flow but also processes all your inbound requests, providing you with pre-researched deals that align with your investment thesis. With Accorata, you can source new deals daily, enrich them with inbound queries, collaborate and share deals, assess hundreds of startups, and integrate seamlessly with your existing tech stack.

One of the key features of Accorata is its ability to deliver startup leads lightning fast. It guarantees new deals every 24 hours from over 30 online sources, making it the fastest on the market. Additionally, Accorata can plug into your inbox to automate inbound sourcing, ensuring you only receive the decks that matter to you. The platform is tailored to your needs, learning from your investment strategy to get you deals where others don't.

Accorata is built with sovereign technology, adhering to the strictest European Data Protection standards. All data is stored on Swiss and German servers, ensuring the highest level of security and compliance. For early adopters and Enterprise customers, Accorata offers co-building opportunities with free and timely IT support, tailor-made integrations, and custom sources.

Testimonials from industry professionals highlight the platform's effectiveness. Berk Aydin, a Tech Investor at High-Tech Gründerfonds, describes Accorata as "a must try" for investment professionals, emphasizing the importance of getting accurate information quickly in the fast-paced world of deal flow. Katharina Aumüller, an Investor at EQT Ventures, praises the tool for making startup scouting much easier, while Noor van Ophem, an Innovation Strategist at Adidas, notes that Accorata "really moves the needle" by addressing the pressing market gap in startup assessment.

Accorata offers a 14-day free trial with no credit card required, allowing you to experience the platform's capabilities firsthand. It also provides premium support with a response time SLA of 24 hours, ensuring that your needs are met promptly. With plans tailored for Business Angels, Basic VC, Data-driven VC, and Enterprise users, Accorata is designed to fit the requirements of a wide range of investors.

By leveraging Accorata, you can save up to 15 hours a week per analyst, access over 30 custom sources, and achieve up to 20x faster sourcing. The platform unifies inbound and outbound sourcing into one single tool, making it an indispensable asset for any startup investor looking to unlock their data-driven potential and shape the future of VC tech.