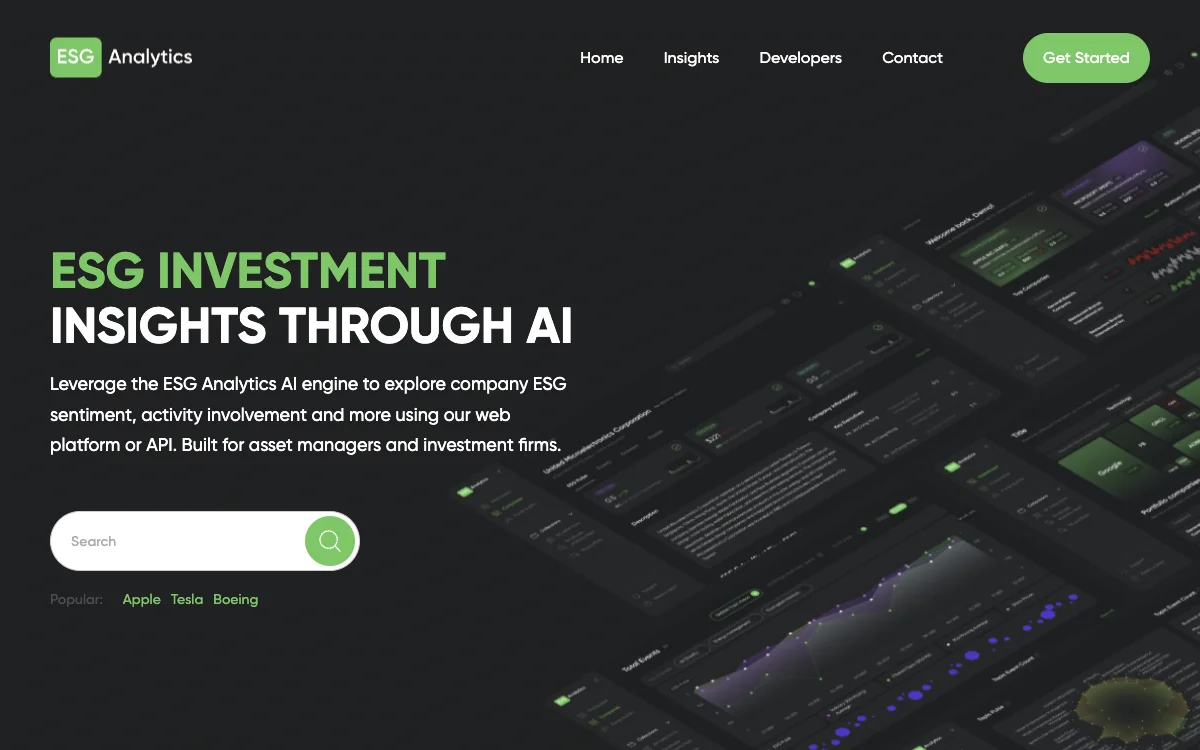

ESG Analytics is at the forefront of integrating artificial intelligence with environmental, social, and governance (ESG) data analysis. This innovative platform offers asset managers and investment firms unparalleled insights into company ESG sentiment, activity involvement, and more. By utilizing the ESG Analytics AI engine, users can access real-time ESG scores and ratings for companies across the globe, including detailed GHG emission data. The platform is designed to cater to the needs of professionals in the investment sector, providing them with the tools to make informed decisions based on comprehensive ESG analytics. Whether through the web platform or API, ESG Analytics ensures that users have the latest ESG insights at their fingertips, enabling them to stay ahead in the rapidly evolving landscape of sustainable investment.

ESG Analytics

Discover ESG Analytics, the AI-driven platform offering real-time ESG scores, ratings, and GHG emission data for global companies, tailored for asset managers and investment firms.

Top Alternatives to ESG Analytics

CYCLOPS

CYCLOPS is an AI-powered ecosystem monitoring platform that offers comprehensive solutions.

Bluewhite

Bluewhite equips farms with autonomous tech for growth

Völur

Völur is an AI-powered tool for optimizing meat industry decisions

Sorted

Sorted is an AI-powered recycling solution that boosts efficiency

Natural Capital Exchange (NCX)

NCX helps landowners find income streams from their land

WattTime

WattTime helps save CO2 with solutions and assistance

Greenbids

Greenbids leverages AI to enhance digital advertising efficiency while significantly reducing carbon emissions.

accessiBe

accessiBe is an AI-powered web accessibility solution that helps businesses comply with ADA and WCAG standards.

Clarity AI

Clarity AI is an AI-powered sustainability platform that helps users invest, shop, and report sustainably with easy-to-use technology.

ESG Analytics

ESG Analytics leverages AI to provide real-time ESG scores and ratings for companies globally, including GHG emission data.

ARC AI

ARC AI offers secure, sustainable AI solutions with personalized experiences and state-of-the-art encryption.

Maintain

Maintain-AI is an AI-powered automated road survey solution that helps optimise road maintenance budgets and improve decision-making.

Treads

Treads is an AI-powered car management subscription that simplifies vehicle maintenance and enhances road safety.

MindBound Labs

MindBound Labs leverages community power to accelerate ASI, offering diverse AI prompts for art, music, and more.

SINAI

SINAI is an AI-powered decarbonization platform that helps enterprises measure, analyze, and reduce carbon emissions efficiently.

Drawerrr

Drawerrr is an AI-powered platform that unites professionals to develop sustainable solutions for companies and governments.

Frondly

Frondly is an AI-powered plant identification app that helps users identify plants, get care advice, and connect with a community of plant enthusiasts.

Ecolink AI

Ecolink AI is a leading sustainability network that verifies brands, connects communities, and drives climate action through commerce.

Dantia

Dantia is an AI-powered investment platform focused on climate change solutions, connecting founders with capital and resources.

Canvass AI

Canvass AI offers Industrial AI solutions that enhance operational efficiency, profitability, and sustainability for industrial workforces.

Credibl ESG

Credibl ESG is an AI-powered platform that simplifies ESG data management and reporting for corporations and investors.