PortfolioPilot: Revolutionizing Financial Management with AI

In the world of finance, making informed decisions is crucial. PortfolioPilot emerges as a powerful tool that combines sophisticated financial models with AI to assist self-directed investors. Let's delve deeper into what makes it stand out.

Introduction

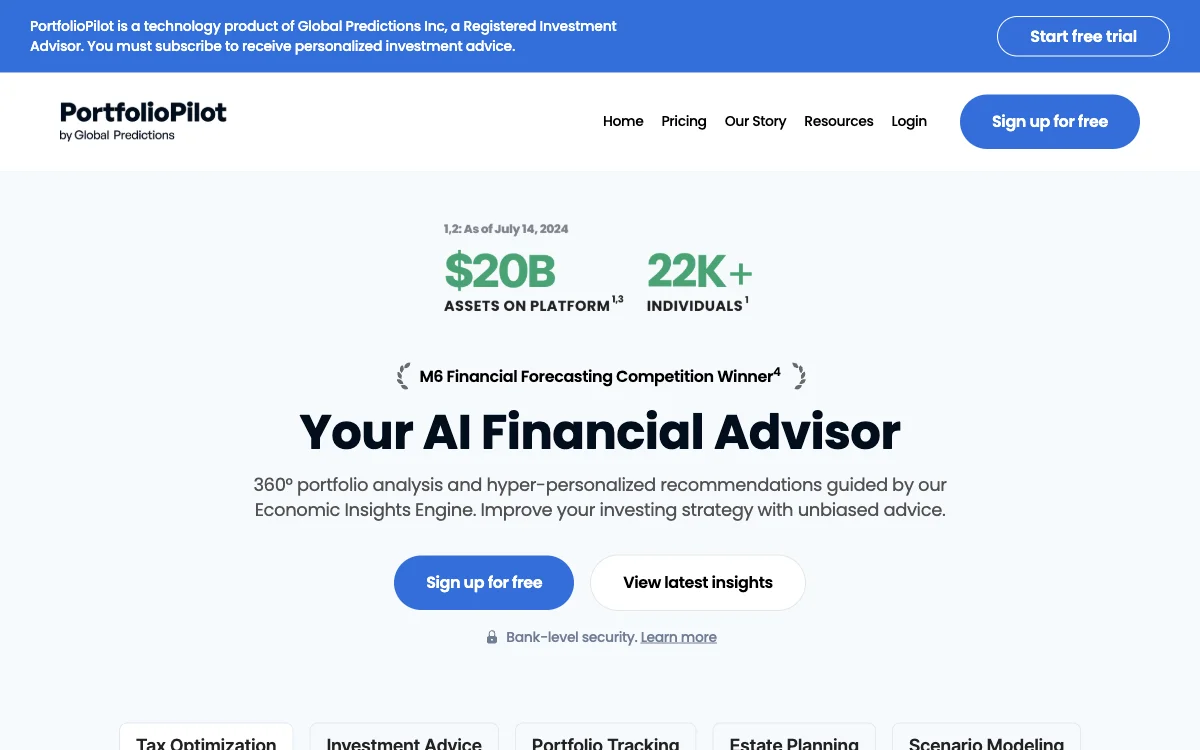

PortfolioPilot is a technology product of Global Predictions Inc, a Registered Investment Advisor. It offers a comprehensive suite of financial services, all powered by AI. With the aim of providing complete financial advice without the typical drawbacks of traditional financial advisors, such as commissions and conflicts of interest, it has become a popular choice among investors.

Key Features

Personalized Investment Advice

The AI at the core of PortfolioPilot takes into account your specific goals and provides actionable recommendations. Instead of you having to keep track of numerous variables, it monitors the economy and guides you accordingly. This personalized approach ensures that your investment decisions are tailored to your unique circumstances.

Net Worth Tracking

You can visualize all your assets in one platform. Whether it's brokerage accounts, 401Ks, IRAs, crypto, cash, student loans, real estate, private equity, precious metals, and more, PortfolioPilot aggregates your net worth and presents a clear view of your entire portfolio allocation. This feature gives you a holistic understanding of your financial standing.

Scenario Modeling

Advanced scenario modelling allows you to test potential outcomes for your investment strategies. You can see how different decisions might impact your portfolio over time. This helps you make more informed choices and prepare for various market conditions.

AI Portfolio Assessment

The tool analyzes critical factors in your portfolio through its AI wealth manager. It automatically reviews your asset allocation and provides investment recommendations based on it. Additionally, it monitors the economy and notifies you when risks arise in your portfolio.

Use Cases

For Self-Directed Investors

PortfolioPilot is designed for those who prefer to take control of their own investments. It provides the necessary tools and advice to manage portfolios effectively without relying on a traditional financial advisor. With features like tax optimization and estate planning, it covers all aspects of financial management.

For Portfolio Analysis

Whether you're looking to discover risks and opportunities in your existing portfolio or want to create a new one, PortfolioPilot offers detailed analysis. Its proprietary engine provides portfolio-specific scoring based on your allocation and recommendations influenced by economic models.

Pricing

PortfolioPilot offers different pricing tiers to suit various needs.

- Free: At $0 per month, you get Smart Portfolio Monitoring, Net Worth Tracking, and Portfolio Analysis. This allows you to stay on top of your finances and understand your portfolio better.

- Gold: For $29 per month, you receive personalized recommendations by an AI Advisor along with real financial advice. This includes features like Tax Impact & Continuous Tax-loss Harvesting, an AI Assistant to answer your questions, and Fee Visualization.

- Platinum: For $99 per month, you gain access to even more advanced tools like AI equity research tools.

Comparisons

Compared to an average financial advisor, PortfolioPilot offers significant cost savings. For example, its Gold pricing is about 97% less than an average financial advisor fee. Moreover, it provides a more personalized and technology-driven approach, leveraging AI to analyze and guide your investments in a way that traditional advisors may not be able to.

Advanced Tips

- Regularly review the insights provided by PortfolioPilot to stay updated on market trends and potential impacts on your portfolio.

- Make use of the scenario modelling feature to plan for different economic scenarios and adjust your investment strategy accordingly.

- Take advantage of the free trial period to fully explore the capabilities of PortfolioPilot and see how it can benefit your financial management.