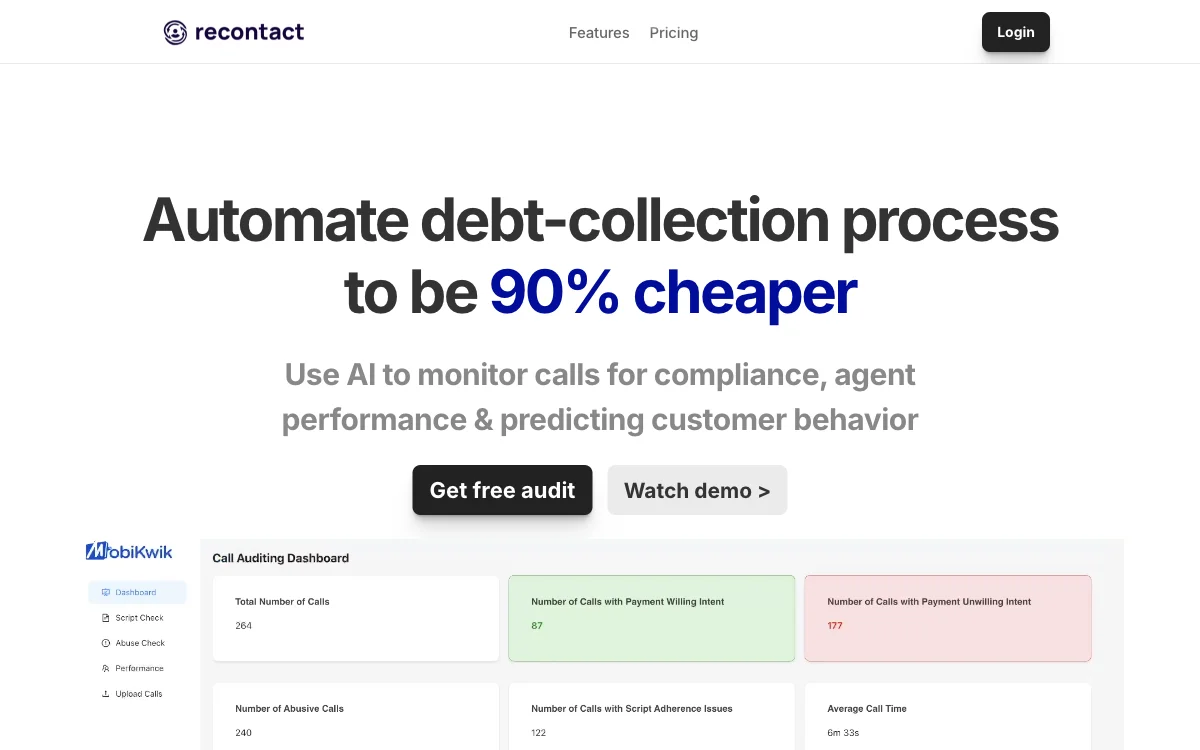

Recontact revolutionizes the debt-collection process by leveraging artificial intelligence to make it significantly more efficient and cost-effective. By automating up to 90% of the process, it not only reduces costs but also ensures compliance and improves agent performance through detailed call analysis.

How It Works:

- Call Importation: Recontact seamlessly imports all your calls from various recording software like Exotel, Zoominfo, Dialpad, and Kaleyra.

- Script and Quality Parameters: Define specific call scripts and quality parameters for your agents. Recontact then monitors how closely these scripts are followed.

- AI Auditing and Insights: Within minutes, Recontact's AI audits all calls, providing searchable insights into agent behavior, compliance, and customer interactions.

Key Features:

- Automatic Violation Detection: Identifies process and critical errors from calls, including abuse detection.

- Agent Performance Tracking: Collates data from thousands of customer calls to understand and improve agent performance.

- Comprehensive Call Analysis: Analyzes every call to suggest areas of improvement for each agent.

- Borrower Behavior Prediction: Sorts PTPs (Promise to Pay) into High, Medium, and Low confidence categories to predict repayment likelihood and optimize collection strategies.

- Efficient Search Functionality: Enables searching across thousands of recordings in seconds, supporting multiple languages.

Pricing: Recontact offers the first call audit for free and integrates with all your loan management software. Additionally, they are developing an Army of AI Voice Agents, which will allow for custom AI agents to call customers anytime, in any language, for assistance.

For inquiries, reach out to . Recontact is a product of Pointfront Technologies Pvt Limited, dedicated to transforming the debt-collection industry with AI technology.