Professional Tax Preparation Software: Intuit Accountants

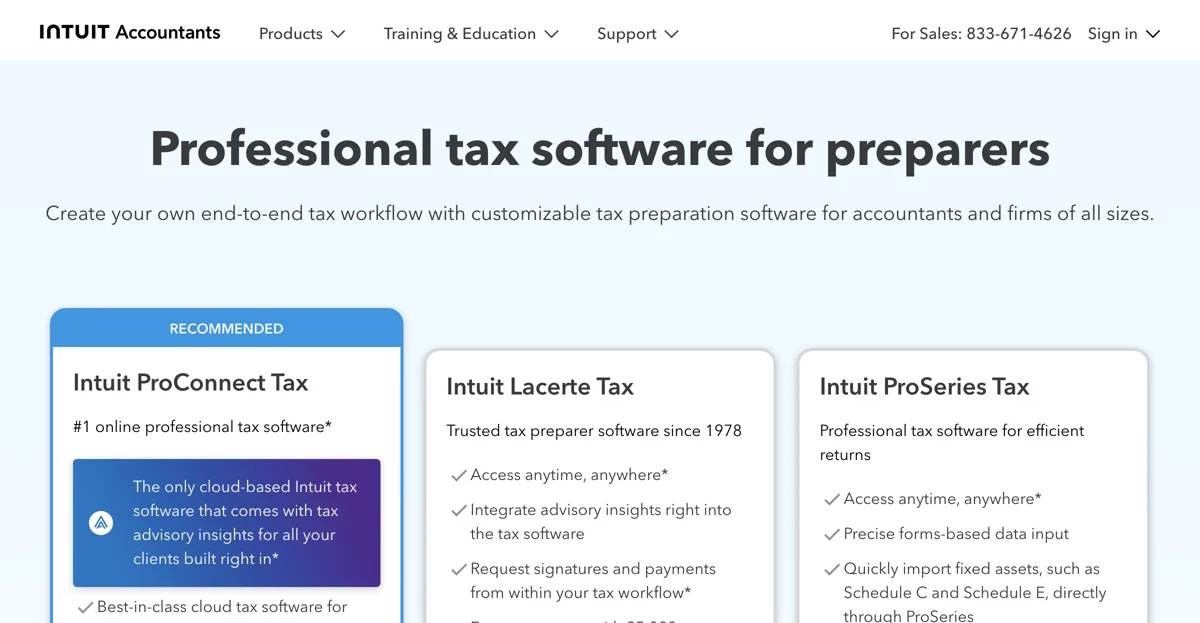

When it comes to tax preparation, efficiency and accuracy are paramount. Enter Intuit Accountants, a suite of professional tax software designed to streamline the tax preparation process for accountants and firms of all sizes. With options like ProConnect, Lacerte, and ProSeries, Intuit offers tailored solutions to meet diverse client needs.

Overview of Intuit Accountants Software

1. ProConnect Tax

ProConnect Tax is Intuit's cloud-based solution, ideal for accountants who need flexibility and accessibility. This software allows you to:

- Create a customized tax workflow that suits your firm's needs.

- Access clients' IRS transcripts directly within the platform.

- Import prior-year 1040 returns to streamline new client setups.

2. Lacerte Tax

Lacerte Tax has been a trusted name in tax preparation since 1978. It is designed for larger firms handling complex returns. Key features include:

- Comprehensive coverage with over 5,700 forms.

- The Like-Kind Exchange Wizard for quick data entry.

- Integration of advisory insights directly into your workflow.

3. ProSeries Tax

ProSeries Tax is perfect for small to mid-sized firms. It offers:

- Forms-based data input for precise tax preparation.

- Easy navigation tools to help you find the right forms quickly.

- The ability to import fixed assets directly, saving time and reducing errors.

Key Features Across All Platforms

- Integration with QuickBooks Online Accountant: Seamlessly connect your accounting and tax software for a more efficient workflow.

- eSignature: Manage client signatures conveniently within the software.

- Protection Plus: Get help for notice resolution and ID theft restoration services.

- Pay-by-Refund: Offer clients a convenient payment option with no upfront costs.

- Client Portal: Use a secure portal to request and send client data.

Training and Support

Intuit provides extensive training resources, including live webinars and knowledge-based articles, to help users get the most out of their software. Personalized customer support is available, ensuring that you have the assistance you need from day one.

Pricing Information

Pricing for Intuit's tax software varies based on the product and features selected. For the most accurate and up-to-date pricing, it’s recommended to visit the official Intuit website or call their sales team at 844-877-9422.

Common Questions

What are the key differences between Lacerte, ProSeries, and ProConnect?

- ProSeries is best for small to mid-sized firms, Lacerte is tailored for larger firms, and ProConnect is fully cloud-based.

Can I integrate QuickBooks with Intuit Accountants software?

- Yes, all Intuit tax software options integrate seamlessly with QuickBooks.

What type of training is available?

- Intuit offers a variety of training options, including live webinars and self-serve resources.

Conclusion

Intuit Accountants provides a comprehensive suite of tax preparation software that caters to the needs of accountants and tax preparers. With its user-friendly interface, extensive features, and robust support, it’s no wonder that many professionals choose Intuit for their tax preparation needs.

Ready to enhance your tax preparation process? Call 844-877-9422 to find the perfect fit for your practice today!