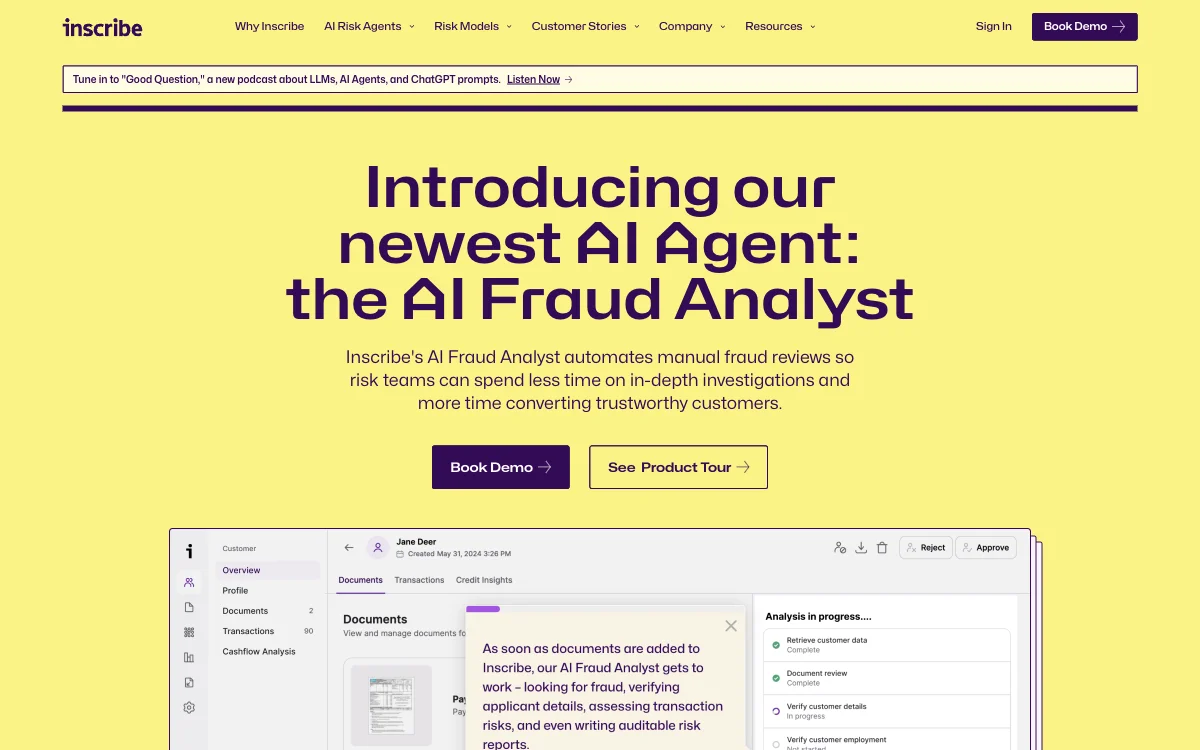

Inscribe is revolutionizing the way risk teams handle fraud detection and document analysis with its advanced AI technology. The AI Fraud Analyst, Inscribe's latest innovation, is designed to automate the tedious process of manual fraud reviews. This allows risk teams to focus more on converting trustworthy customers rather than spending countless hours on in-depth investigations. With Inscribe, reviewing 30 customer applications takes just 1.5 minutes, leading to a 99% reduction in manual review times and generating over $85k in additional productivity per full-time employee.

Inscribe's AI Risk Agents and state-of-the-art Risk Models are trusted by leading fintechs, banks, and lenders to automate complex onboarding and underwriting workflows. These AI solutions enable risk and operations teams to do more with less headcount, eliminating the need for increased budgets or additional engineering resources. In an ultra-competitive market, Inscribe ensures fast response times by connecting the dots across all systems, allowing teams to focus on strategies for approving more customers faster.

Moreover, Inscribe's AI technology is pivotal in reducing avoidable fraud losses. In today's challenging macro environment, fraud and credit losses are no longer acceptable costs of doing business. Inscribe uses the most advanced AI and machine learning technology to illuminate fraud and credit risks that are undetectable to human reviewers. This not only helps in shrinking margins but also in safeguarding the business against potential fraud.

For those not ready to fully integrate AI Risk Agents, Inscribe offers state-of-the-art machine learning Models, including fraud detection, document parsing, and cashflow analysis. These Models have been trained on the largest, most diverse network of real-world documents from banks, fintechs, and lenders since 2017, ensuring the delivery of trustworthy data.

Inscribe's commitment to transforming knowledge work with AI is evident in its resources, including a new podcast about LLMs, AI Agents, and ChatGPT prompts. By deploying an AI Risk Agent, businesses can unlock superhuman performance, making Inscribe an indispensable tool for risk teams aiming to stay ahead in the fast-evolving financial landscape.