WorkFusion introduces a groundbreaking approach to Anti-Money Laundering (AML) compliance through its AI Digital Workers. These pre-trained AI agents are designed to automate and scale compliance operations, significantly mitigating financial crime risk. With years of AML experience embedded, these digital workers can quickly adapt to the needs of compliance organizations, offering a smarter, faster, and more cost-effective solution than traditional hiring or outsourcing methods.

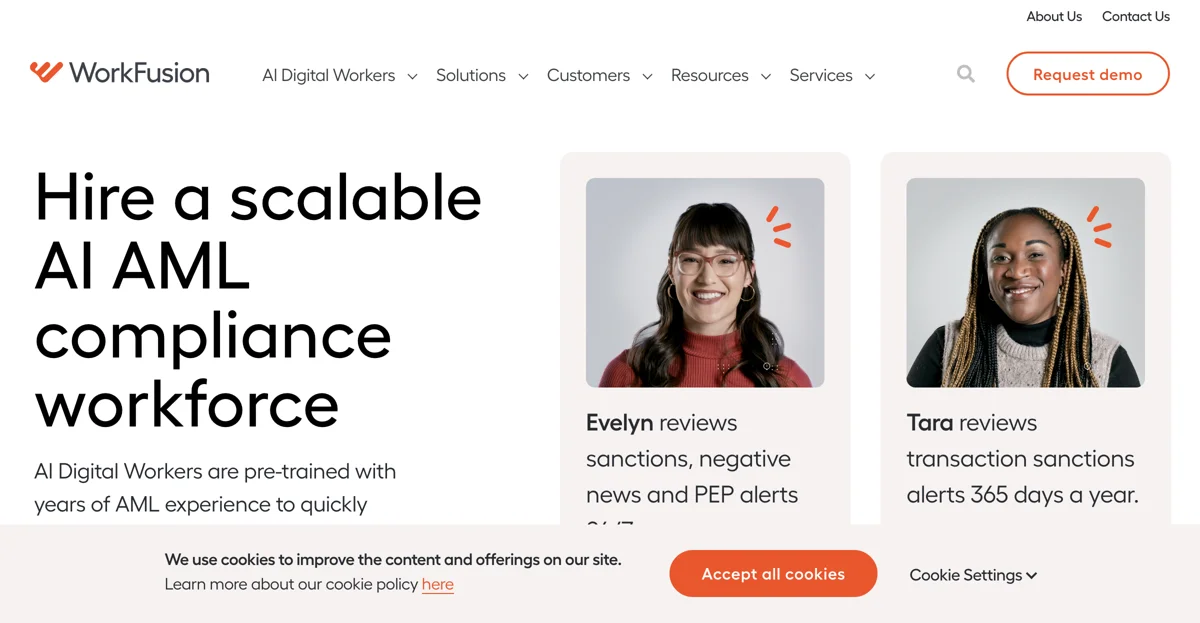

AI Digital Workers by WorkFusion are capable of fulfilling complete level 1 AML analyst roles, including sanctions screening alert review, adverse media monitoring, transaction monitoring investigations, KYC, and pKYC. They come ready to perform, akin to hiring an employee with five years of experience, and are enhanced with GenAI to accelerate automation rates up to 95% STP, reduce error rates, and go beyond current template-based narratives.

By automating the tedious aspects of compliance work, WorkFusion's AI Digital Workers allow human analysts to focus on areas that pose the most risk to the business. This not only improves efficiency but also enhances the quality and consistency of compliance operations. The AI agents are proven technology controls that AML compliance organizations can integrate into their risk mitigation toolkit, offering a dynamic solution to scale team capacity in response to increasing alert volumes without sacrificing quality.

WorkFusion's AI Digital Workers are already serving 4 of the top 5 US banks and leading financial institutions worldwide, demonstrating their effectiveness in the complex and challenging field of financial crime compliance. With features like explainable AI aligned with MRM to explain decision-making processes and the ability to dynamically scale to meet organizational growth targets, WorkFusion is setting a new standard in AML compliance technology.