Chargezoom is an AI-driven accounts receivable management solution. It automates tasks to simplify the process, minimize errors, and save time and resources. Its key features are automated receivables, digital payment integration, billing and invoicing automation, and intelligent AR automation and reporting. This helps businesses accelerate cash flow, save time on AR, and make better decisions with AI. Pricing plans are available to meet diverse business requirements. It is more efficient and streamlined than traditional methods. Advanced tips include reviewing reports, encouraging digital payments, and using automation for payment reminders. In summary, Chargezoom provides an efficient and economical way to manage finances.

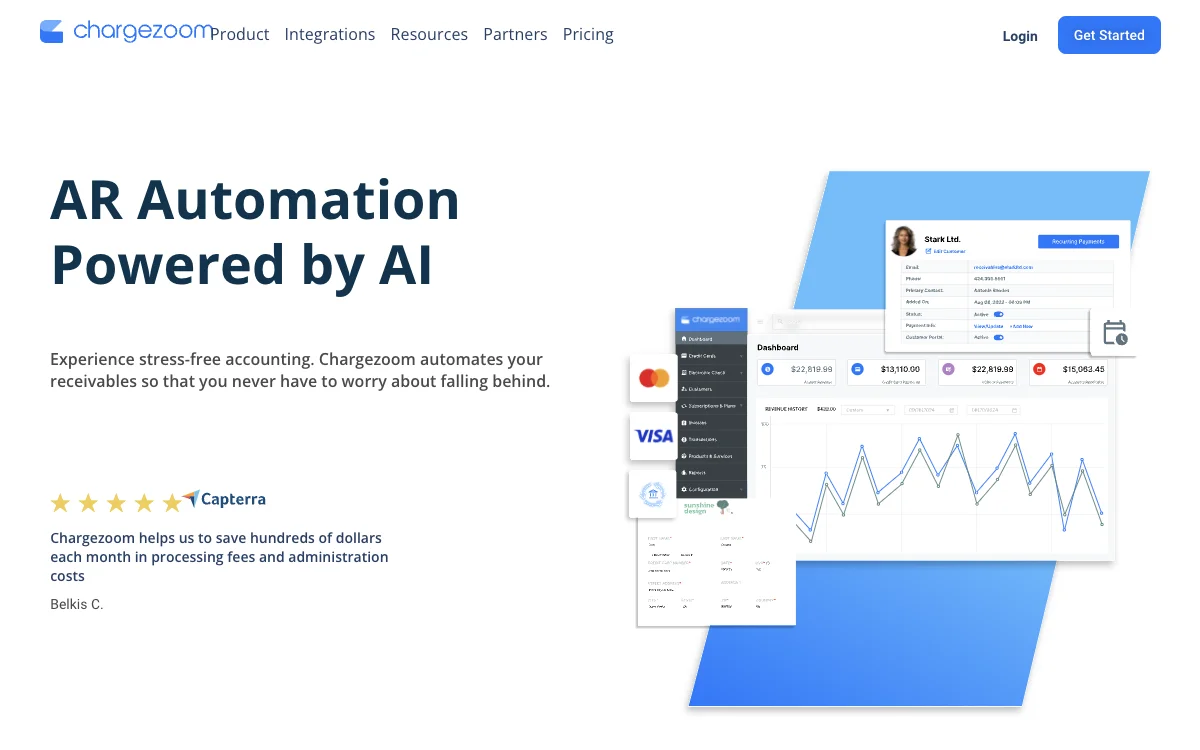

Chargezoom

Chargezoom uses AI to automate accounts receivable, saving time and costs. Discover how it accelerates cash flow, simplifies billing, and offers valuable insights for businesses.

Top Alternatives to Chargezoom

SMACC

SMACC is an AI-powered accounting tool that simplifies invoice processing

Wave

Wave is an AI-powered financial tool that simplifies business management

BILL Spend & Expense

BILL Spend & Expense is an AI-powered expense management solution that simplifies reporting and control.

Gappify

Gappify is an AI-powered accrual automation tool that saves time and reduces errors.

Xero

Xero is an AI-powered accounting software that simplifies sales tax

Receiptor AI

Receiptor AI automates receipt and invoice extraction, saving time

QuickBooks

QuickBooks is an AI-powered accounting assistant that simplifies business management.

BringTable

BringTable is an AI-powered bill analyzer that simplifies data management

Billy

Billy is an AI-powered invoicing tool that simplifies invoice creation and management for individuals and small businesses.

Edison by FDO

Edison by FDO is an AI-powered business tool that simplifies financial recordkeeping, allowing you to focus on running your business.

Booke AI

Booke AI automates bookkeeping tasks in QuickBooks Online and Xero, saving time with AI-driven RPA and Generative AI.

BlackLine

BlackLine offers AI-powered software solutions to optimize financial workflows, reduce risk, and prepare for strategic F&A challenges.

Proco

Proco transforms accounting and financial reporting through automation, streamlining workflows for faster monthly closes and enhanced insights.

Vic.ai

Vic.ai is an AI-powered platform that optimizes accounts payable processes, enhancing invoice processing productivity by 355%.

iKapture

iKapture is an AI-powered accounts payable automation platform that enhances cash flow monitoring and document data extraction.

FinFloh

FinFloh is an AI-powered accounts receivable software that automates and streamlines the invoice-to-cash process for B2B finance teams.

SnaptoBook

SnaptoBook is an AI-powered personal accounting software that simplifies receipt management, reimbursement, and tax filing.

AIAccountingApps.com

AIAccountingApps.com is a comprehensive directory of AI-powered accounting software designed to automate financial workflows for professionals.

Mesha

Mesha is an AI-powered accounts receivable software that automates invoice follow-ups and reconciliation, saving businesses time and improving cash flow.

TurboDoc

TurboDoc is an AI-powered invoice processing tool that transforms unstructured invoices into structured data, saving time and reducing errors.

Osfin

Osfin is an AI-powered financial operations platform that helps businesses automate accounting, reconciliation, and payouts.