Transparently.AI is a revolutionary AI solution designed to address the critical issue of accounting manipulation and fraud. This advanced system is specifically built for financial analysts, portfolio managers, and regulators, offering a highly effective means of detecting potential risks. The Transparently Manipulation Risk Analyzer (MRA) is at the core of this solution. It sifts through millions of data points and utilizes 150 factor models grouped into 14 risk clusters to rank the probability of accounting fraud causing corporate collapse. In just a few seconds, it delivers an accurate 0 - 100 percentage score along with a detailed custom report and next-step recommendations. This not only saves valuable time but also empowers financial experts to make more informed investment decisions. One of the key advantages of Transparently.AI is its ability to provide contextual insights. Unlike other solutions that may only offer a risk score, this AI-powered tool delivers detailed reports that explain how and why a company scores high or low. This level of detail helps users better understand the underlying reasons behind a company's potential risks, enabling them to take appropriate actions. Another significant benefit is the time and cost savings it offers. Analyzing a company's probability of failure in a matter of seconds can prevent potentially costly investments and minimize financial losses. Moreover, Transparently.AI is committed to ethical and sustainable practices. Using the power of AI and machine learning, it strives to bring clarity, confidence, and governance to the world of finance. The solution also provides access to historic data sets, allowing users to analyze any historical financial year to gain a comprehensive understanding of a company's financial health. Transparently.AI is not just a tool; it's a comprehensive solution that combines advanced technology with expert knowledge. The team behind it is composed of skilled RegTech experts who are dedicated to providing excellent support and ensuring that users have a seamless experience. Whether you're a financial institution, an audit firm, or an individual investor, Transparently.AI can be a game-changer in the fight against accounting fraud and manipulation.

Transparently.AI

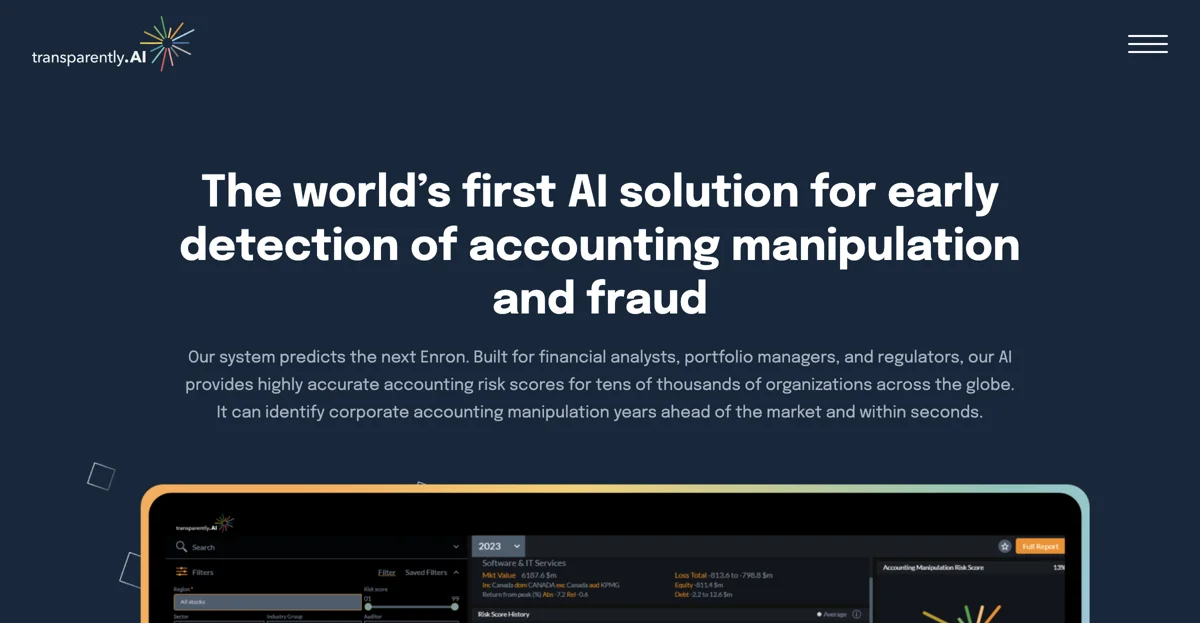

Transparently.AI offers highly accurate accounting risk scores, saving time and providing detailed insights for better investments.

Top Alternatives to Transparently.AI

SMACC

SMACC is an AI-powered accounting tool that simplifies invoice processing

Wave

Wave is an AI-powered financial tool that simplifies business management

BILL Spend & Expense

BILL Spend & Expense is an AI-powered expense management solution that simplifies reporting and control.

Gappify

Gappify is an AI-powered accrual automation tool that saves time and reduces errors.

Xero

Xero is an AI-powered accounting software that simplifies sales tax

Receiptor AI

Receiptor AI automates receipt and invoice extraction, saving time

QuickBooks

QuickBooks is an AI-powered accounting assistant that simplifies business management.

BringTable

BringTable is an AI-powered bill analyzer that simplifies data management

Billy

Billy is an AI-powered invoicing tool that simplifies invoice creation and management for individuals and small businesses.

Edison by FDO

Edison by FDO is an AI-powered business tool that simplifies financial recordkeeping, allowing you to focus on running your business.

Booke AI

Booke AI automates bookkeeping tasks in QuickBooks Online and Xero, saving time with AI-driven RPA and Generative AI.

BlackLine

BlackLine offers AI-powered software solutions to optimize financial workflows, reduce risk, and prepare for strategic F&A challenges.

Proco

Proco transforms accounting and financial reporting through automation, streamlining workflows for faster monthly closes and enhanced insights.

Vic.ai

Vic.ai is an AI-powered platform that optimizes accounts payable processes, enhancing invoice processing productivity by 355%.

iKapture

iKapture is an AI-powered accounts payable automation platform that enhances cash flow monitoring and document data extraction.

FinFloh

FinFloh is an AI-powered accounts receivable software that automates and streamlines the invoice-to-cash process for B2B finance teams.

SnaptoBook

SnaptoBook is an AI-powered personal accounting software that simplifies receipt management, reimbursement, and tax filing.

AIAccountingApps.com

AIAccountingApps.com is a comprehensive directory of AI-powered accounting software designed to automate financial workflows for professionals.

Mesha

Mesha is an AI-powered accounts receivable software that automates invoice follow-ups and reconciliation, saving businesses time and improving cash flow.

TurboDoc

TurboDoc is an AI-powered invoice processing tool that transforms unstructured invoices into structured data, saving time and reducing errors.

Osfin

Osfin is an AI-powered financial operations platform that helps businesses automate accounting, reconciliation, and payouts.